Broad Match: The Paid Search AI Frontier

In the ever-evolving landscape of Paid Search advertising Broad Match has emerged as a key player, touted by both Google and Bing as the gateway to expanded reach and enhanced performance. Our data-driven exploration seeks to unravel the intricacies of these offerings and gauge the fulfillment of such promises. Here's what the data tells us about the unique paths Bing and Google are carving through their AI-integrated algorithms and what that means for the future of search advertising.

Broad Match Increases Auction Competition Driving Up CPCs

Both Bing and Google have aggressively courted advertisers to their Broad Match offerings. It's no coincidence that both Search Engines have seen ad revenues increase more than their traffic volume. Tinuiti's Q4 2023 Digital Ads Benchmark Report showed Google CPCs were up 19% in Q4 2023. By expanding the target audience, ie queries available for bidding, Broad Match creates increased auction competition driving up CPCs and thereby maximizing the Search Platforms' ROI on existing ad inventory. Despite the aggregate impact on the CPCs in the Paid Search ecosystem Broad Match will continue to unlock new opportunities for savvy advertisers as it evolves.

Google's Approach: Beyond Keywords to a Unique Reach

Google's Broad Match algorithm stands out for its innovative approach. It goes beyond the traditional use of keywords to include a variety of variables such as the user's location, recent searches, the landing page, and other relevant signals. Our experimentation indicates that this multifaceted approach allows Google to serve ads that align more closely with the users' current interests, thus providing advertisers with a unique and expanded audience reach.

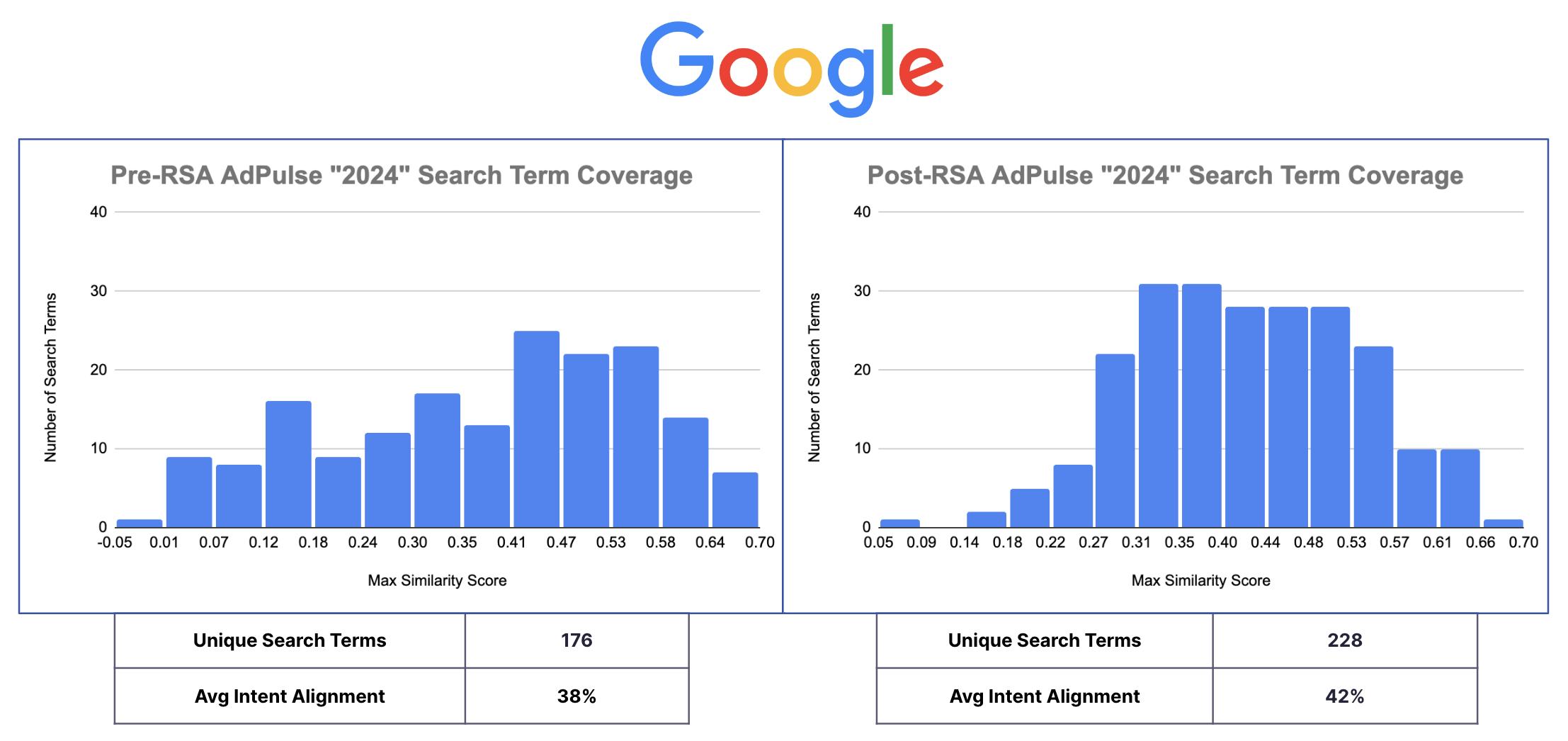

For instance, when ad copy is updated to include certain terms, such as "2024," Google's Broad Match quickly adapts. We observed a spike in unique search terms that relate to the new ad copy, demonstrating Google's ability to dynamically match search queries based on content. This suggests that ad content can be a proactive tool for advertisers on Google to target and reach specific audiences, achieving an incremental breadth that Bing currently cannot match.

Bing's Broad Match: Still Restrained by Keywords

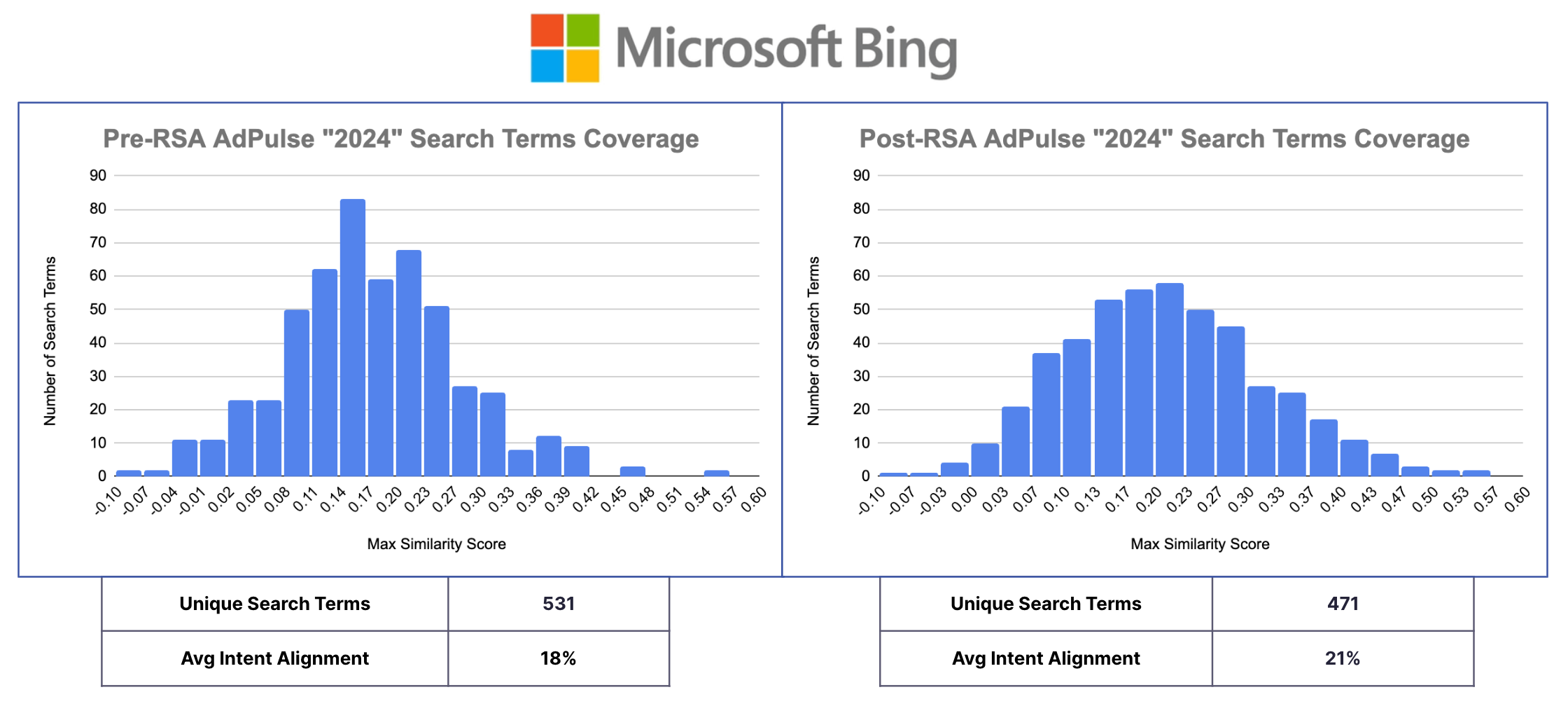

Bing has repositioned its Broad Match offering as the new norm, aiming to outdo Phrase Match in audience reach without sacrificing performance. The intent seems clear: cast a wider net without compromising the quality of the catch. However, the innovation seems muted, with Bing's AI application in audience matching appearing more nascent than transformative.

Our analysis, visualized in the accompanying chart, reveals that Bing’s Broad Match aligns closely with Phrase Match logic and delivers similar performance. As a result the average intent alignment increases from 18% to 21% after the 2024 ad copy is deployed. However, there is no evidence that more unique queries were matched to the ad copy as seen on Google. In fact, unique queries decreased and performance improved. So while Bing intent alignment can drive more volume and better quality it is not being used as a direct source for query matching. This incremental change suggests that Bing's Broad Match may still be in its early stages of evolution.

Quantitative Insights: The Battle of 2024 Metrics

The core of our analysis lies in the hard numbers. When comparing Bing and Google's Broad Match against Exact/Phrase Match Types a story unfolds in the metrics:

- Cost Per Click (CPC): Google advertisers enjoy a decrease in costs by 11%, while Bing's costs inflate by 27%. This suggests Google’s efficiency in auction dynamics, possibly offering better value for money.- Click-Through Rate (CTR): Bing's modest -11% drop contrasts starkly with Google's significant 38% dip, hinting at higher ad relevance in Bing's search results.

- Conversion Rate: Here, Bing boasts a +4% increase, outpacing Google's -13% decrease, underscoring Bing's focus on retaining performance alongside reach.

- Share of Total Spend: Google claims a lion's share of 53% against Bing's 16%, reflecting the greater incremental reach achieved by Google's broader audience matching logic.

- Return On Ad Spend (ROAS): Google nearly breaks even at -1%, while Bing trails with a -19% ROAS, indicating Google's advantage in balancing cost with revenue generated.

|

Broad vs Exact/Phrase Match |

Bing |

|

|

CPC vs Others |

+27% |

-11% |

|

CTR vs Others |

-11% |

-38% |

|

Conversion Rate vs Others |

+4% |

-13% |

|

Share of Total Spend |

16% |

53% |

|

ROAS |

-19% |

-1% |

Ad Content's Role in Expanding Reach

In a statement following the latest Microsoft earnings call Satya Nadella, Chairman and CEO of Microsoft, said, "By infusing AI across every layer of our tech stack, we’re winning new customers and helping drive new benefits and productivity gains across every sector.” Given Bing's limited 8% share of the US paid search market it's reasonable to expect that chief among those innovations would be the application of AI to Bing's audience matching algorithms. By its own definition and confirmed by our experimentation, Bing's Broad Match algorithm lags behind Google in AI innovation.

Both Google and Bing use the relationship between ad content and keywords as part of their Quality Score algorithm, which can help increase traffic from existing audiences. However, our research indicates that only Google is leveraging ad content beyond Quality Scores to expand its Broad Match reach. This is not an advertised feature of Google's Broad Match algorithm, but the impact is evident in the increase of unique search terms related to the ad content immediately following the deployment of new ad copy—a phenomenon not observed with Bing.

Strategic Implications for Advertisers

What does this mean for advertisers? On Bing, unique reach is primarily driven by new keywords, improved Quality Scores, increased budgets, or lowered performance targets. However, this tends to attract less targeted traffic, necessitating a heavier reliance on Negative Search Terms for optimization. On Google, while advertisers can utilize the same levers, the added dimension of targeted ad copy for directly expanding unique audience reach provides a significant advantage. Google’s Broad Match not only casts a wider net overall, but it also enables the capture of more unique audience segments by tuning ad copy to specific consumer intents.

Conclusion

As it stands, Google's application of AI in Broad Match is pioneering a new era of search advertising— one that embraces the subtleties of user intent and content relevance to drive performance. While Bing still maintains a focus on keyword-centric matching, Google’s approach ushers in a strategic flexibility that advertisers can leverage for more nuanced and effective audience targeting. As AI continues to advance, the capacity to interpret and impact the dynamic elements powering audience matching algorithms will be crucial for advertisers aiming for performance and scale in their Paid Search campaigns.